Tools of the trade. When you think of technology, you think about computers, digital data, hardware, and software. These common tools are used daily in the insurance industry for processing claims. When it comes to the relationship between technology, insurance, and restoration, the important factors are ease of use and speed. The role of technology in the insurance and restoration industry is to generate process optimization. When rebuilding after a disaster, you must first be able to examine the aftermath before assessing the damages for repairs. The use of digital tools makes it easier for insurance adjusters and restoration contractors to connect. Technology provides platforms to get the job done faster than ever before and overcome some of the day-to-day challenges in the industry.

Challenge number one: Documentation

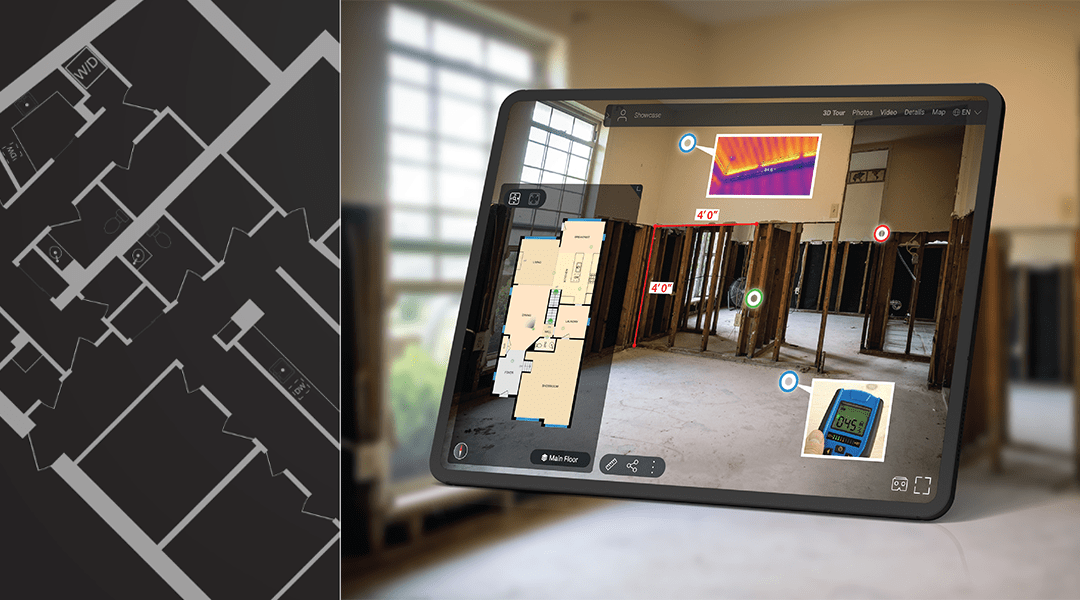

The insurance restoration business is challenging. Getting accurate reconstruction estimates can be difficult, especially without the proper tools. It is not uncommon for restoration companies to revisit a project on multiple occasions for the purpose of gathering overlooked information. Wasting time by returning to a job time after time disrupts the workflow and can make you appear unprofessional. Digital tools are available to assist in speeding up the process while eliminating the need to continually re-visit the site. Through the use of modern technology like iGUIDE, documenting a loss is quick and easy. Everything, from measurements to 3D tours, can be captured during pre-mitigation and post-mitigation in a single visit.

Challenge number two: Accuracy

How many times have you re-measured a space only to find that you have different numbers each time? Is it haste that causes mistakes or is it the lack of the proper tools? Either way, accuracy is crucial when providing an Insurance Restoration quote. Mistakes cost you money and delay remediation. Documenting a loss using accurate square footage allows you to quote a project more quickly and with confidence. The results are improved productivity and a reliable assessment of the project.

Challenge number three: Sharing information

When you are involved in the Insurance & Restoration industry, it is your job to get quotes from various contractors. No matter what the project entails, your process optimization skills benefit from reliable technology. According to a recent article by McKinsey and Company, technology trends will reshape the insurance industry over the next decade. Sharing everything about a project in real time while on-site can eliminate unnecessary delays. The ability to upload information directly into software programs like Xactimate makes quoting a claim easier and faster.

Challenge number four: Ease of use

Easy as pi π. Calculations can often get mixed up when measuring unusual spaces. Not every building is a perfect square or rectangle. iGUIDE Radix® has a simple-to-use process for insurance adjusters and restoration contractors. With its lidar accurate measurements, the typical iGUIDE measurement uncertainty in distance measurement on a floor plan is 0.5% or better and the corresponding uncertainty in square footage is 1% or better. Every 3D space is captured within this window of uncertainty. Damage documented pre-mitigation eliminates difficulties dealing with a “he said – she said” situation after the repairs are complete. An easy way to compare before and after property conditions are through comprehensive 3D tours captured at the onset of the claim and re-visited at the conclusion.

Challenge number five: Speed

What can help you increase the number of Insurance & Restoration industry projects completed in a week? Speed! Closing claims faster all begins with using available technology now. Tech-savvy industry members process more claims with a higher degree of accuracy using tools that allow data to be uploaded and shared instantly. Reduced travel time and labor costs result in a seamless workflow, while automation helps meet the time-constraint demands of the industry.

Closing claims quicker is dependent on the speed at which information can be captured, documented and shared. These challenges can be easily overcome by implementing technological tools at every stage of an insurance claim. Digital tools offer adjusters and contractors a way to maintain professionalism and satisfy the needs of both the consumer and the insurance companies. When estimating the cost of damages, one click can translate destruction into restoration quickly with iGUIDE.